- Enhanced tax benefits

- Promotion of digital products

- Support for low-income groups

I am a passionate content writer with over three years of experience in the insurance domain. An avid learner, I always tries stays ahead of the industry's trends, ensuring my writing remains fresh and includes the latest insurance shifts. Through my work, I strive to engage with targeted insurance readers.

Reviewed By:

Priya has been in the content writing industry for over 9 years. She has been religiously following the insurance sector since the start of her career which makes her an avid insurance expert. Her forte lies in health, term, and life insurance writing, along with her knowledge of the latest developments in the insurance sector.

Updated on Aug 13, 2024 4 min read

Budget 2024: Receive higher payouts on life insurance policies from October 1, 2024.

Every year, the central government issues its list of expenditures for all sectors ( in a union budget) for the same financial year. After thoroughly studying the Indian economy and consulting with all the members of parliament, the government issues a budget that helps all sectors to grow and sustain.

Apart from setting an expenditure ratio, the government also carefully increases and decreases the existing tax rate slabs for better development and sustainable growth of the economy. This article will briefly study the Budget 2024 insurance changes and how they will impact regular customers.

What are the changes for life insurance in the 2024 budget?

By strictly working on IRDAI's mission- "Insurance for all by 2047", the central government has focused significantly on the insurance sector in budget 2024.

The following changes are announced for the insurance sector in budget 2024:

- TDS or (tax deducted as source) on life insurance policies payouts would be reduced from 5 % to 2%. (Effectively starts from October 1, 2024)

- The commission or any payout subject to TDS on life insurance policies would also be reduced from 5% to 2%. (Effectively starts from April 1, 2025)

How do the reduced TDS rates help the potential life insurance policy customers?

TDS or Tax deducted at source is the amount deducted from the payer before transferring the balance to the payee. Before the union budget 2024, the TDS rate on insurance was 5% for all types of payout paid to nominees. Let us understand by the example:

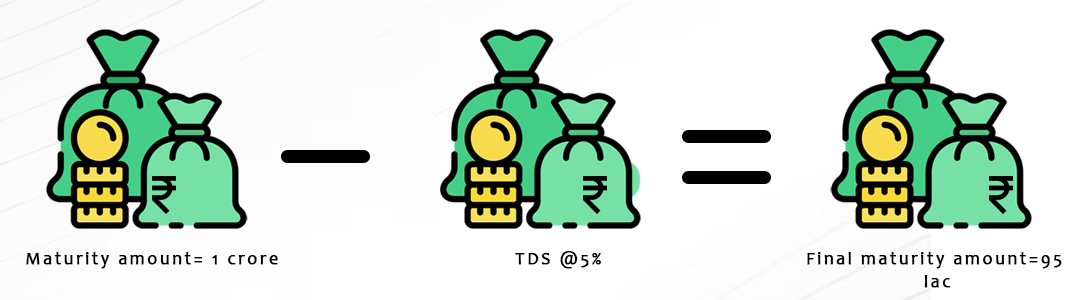

Suppose Mrs. Bhavna Gupta has had a life insurance policy for 25 years, which will mature in June 2024 now, if the maturity amount she will receive is Rs. 1 Crore. So, as per the old TDS tax regime, she will be charged 5% of TDS to the insurer company. Either she chooses to receive the maturity amount in lump sum or regular guaranteed income, she will be charged the same.

Let's see a brief illustration of her payout:

However, if she chooses to receive the maturity amount via regular income for a certain period of years. she will be charged the same @5% TDS on each payout.

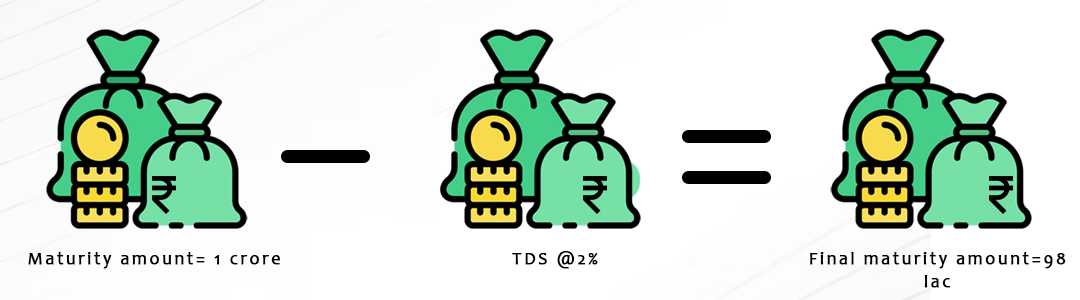

Now, as per the new TDS tax rates of Budget 2024 with the same parameters, let's see the brief illustration she will receive:

So, if we compare the old TDS rate vs. the new TDS Rate, she is saving a wholesome Rs. 3 lakhs on maturity. Now you see, it's just an illustration for a single customer. Millions of customers whose life insurance policies will mature this year will save a large pool of money, which can further come to the Indian market and help it grow.

How do the reduced TDS rates help the insurer?

The insurance industry works on a simple principle of commissions. The more policies sold by an agent or the business, the higher the commission would be paid. Now, TDS will also be charged for these commissions before the final payout. So, as per the existing rate of TDS, @5% would be charged.

For example, If an insurance company has to pay a 1 Lac commission to the agent, the company would deduct Rs. 5000/- as TDS from the final payment.

However, per the 2024 budget, the TDS rate would be deducted to 2%, meaning the insurer company would pay much higher than the old tax rate.

For example, If an insurance company has to pay a 1 Lac commission to the agent, the company would deduct Rs. 2000/- as TDS from the final payment.

In a Nutshell

The Budget 2024 impact on life insurance is significant and multifaceted. By enhancing tax benefits, promoting digital insurance platforms, and supporting low-income groups, the government aims to make life insurance more accessible, affordable, and efficient for all citizens.

Life insurance budget 2024 : Faq

1. What changes are done in the life insurance segment in budget 2024?

In budget 2024, one of the major changes is reducing the TDS rate on life insurance policy payouts from 5% to 2%.

2. Who will benefit the most from a reduced TDS rate on life insurance policies?

Annuity plan holders of life insurance will benefit the most from a reduced TDS rate.

3. What is the government& 039;s aim for the life insurance sector in budget 2024?

The Government aims to enhance tax benefits, promote digital solutions, and support life insurance groups.

4. What are the benefits for insurer companies in budget 2024?

As per budget 2024, the commission rate paid to the agents or web aggregators is reduced from 5% to 2 %.

Life Insurance Companies

Share your Valuable Feedback

5

Rated by 1 customers

Was the Information Helpful?

Select Your Rating

We would like to hear from you

Let us know about your experience or any feedback that might help us serve you better in future.

Written By: Varun Saxena

I am a passionate content writer with over three years of experience in the insurance domain. An avid learner, I always tries stays ahead of the industry's trends, ensuring my writing remains fresh and includes the latest insurance shifts. Through my work, I strive to engage with targeted insurance readers.

Reviewed By: Anchita Bhattacharyya

Reviewed By: Anchita Bhattacharyya

Do you have any thoughts you’d like to share?